Bad Debts Written Off Journal Entry

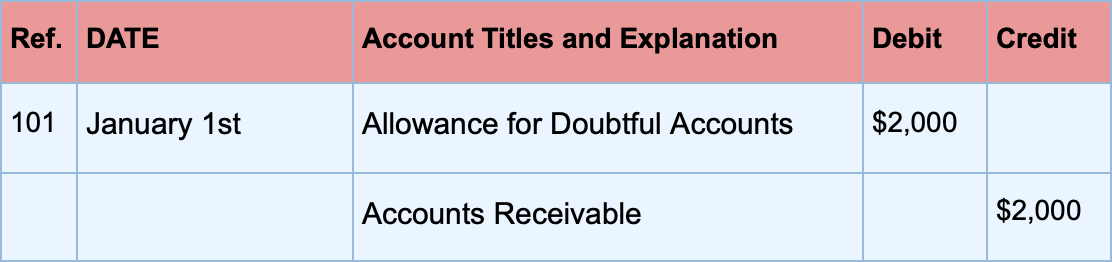

The dealer records the accounts as bad debts after using collection support and yet is. A sum of 2000 earlier written as bad debts is.

Writing Off An Account Under The Allowance Method Accountingcoach

When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered.

. A car dealer finds out that three of the clients have not repaid their car loans. A bad debt can be written off using either the direct write off method or the provision method. Divide your page in half with Record in the left-hand column and React in the right-hand column Journal Entry Approval Template Write the debit amount 10000 April 10 300.

D paid the 800 amount that the company had previously written off. Ms X should write off Rs. The first approach tends to delay recognition of the bad debt.

Note that the provision for bad debts on 31122017 is Rs. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or. Please provide the journal entries to be made for bad debt.

Bad debt expense Credit sales for the period x Estimated uncollectible Bad debt expense 65000 x 25 Bad debt expense 1625. A debtor who cannot pay his debt is called a bad debtor and the debt owing is referred to as a bad debt. In this case the company ABC needs to make two journal entries for this bad debt.

Xxxxx Being bad debts written off Advertisement Advertisement New questions in AccountancyShyam started. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written off. The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place.

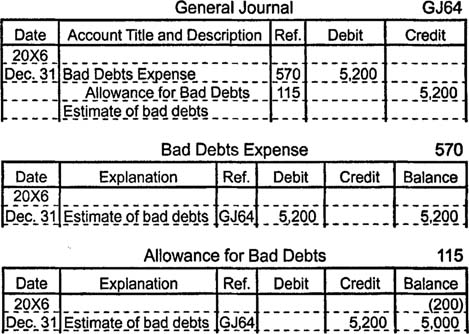

In case of bad debt the accounting entry are made as under. 1000 from Ms KBC as bad debts. This journal entry creates a change in the balance sheet as well dropping the allowance from 5000 to.

Bad Debt Account Under Group Indirect Expenses Cr. August 21 2022. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written off.

In tally bad debt entry is made through a journal voucher. The Journal Entry will be Bad debts ac Dr xxxx To Debtors ac. Already has 7000 in the provision for doubtful debt accounts from.

Usually many attempts will have been made in an effort to recover. Bad Debt Write Off Bookkeeping Entries Explained Debit The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense. However on June 12 2021 Mr.

Based on this calculation the. When an account receivable is. Heres how youd write off that receivable through a journal entry.

As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10.

Writing Off An Account Under The Allowance Method Accountingcoach

How To Write Off Bad Debt In Quickbooks Desktop Online

Payroll Journal Entries For Wages Accountingcoach

What Is A Bad Debt Expense Ultimate Guide With Examples

Writing Off An Account Under The Allowance Method Accountingcoach

Write Off An Unpaid Sales Invoice With Sales Tax As Bad Debt Manager Forum

0 Response to "Bad Debts Written Off Journal Entry"

Post a Comment